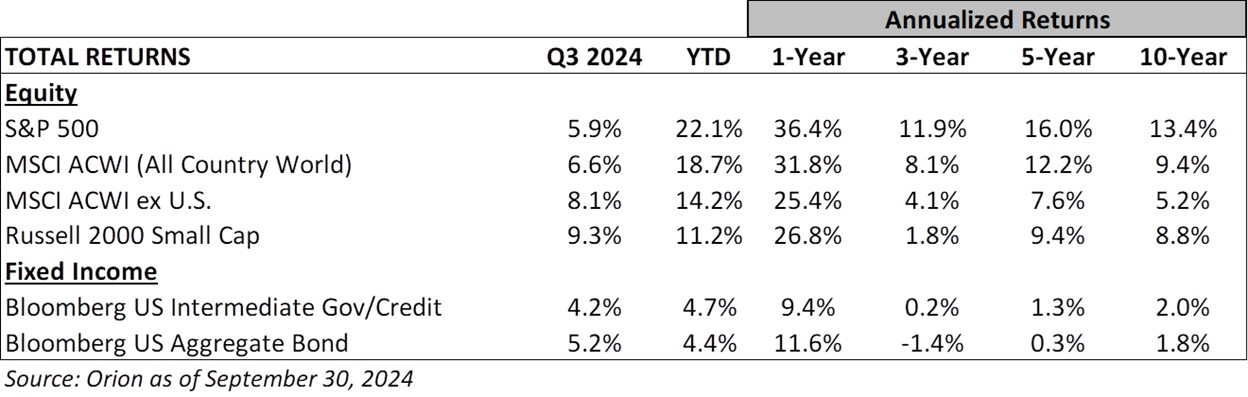

The third quarter proved volatile on many fronts. The major market indices experienced a drawdown of nearly 10% in early August only to reach all-time highs by the end of September, leaving the S&P 500 and All-Country World indices up 22% and 19% for the year. Bonds rallied into and upon the Federal Reserve’s anticipated rate cut. Yet, in the trading days since, the prices of bonds for three years and longer have fallen. Intermediate-term yields are now higher than before the half-point cut. For the year, however, yields are down, and the total bond index is up 5%.

"As an investor, you love volatility. You love the idea of wild swings because it means more things are going to get mispriced." Warren Buffett, 1997

Outside of stocks and bonds, prices for many precious metals rose, including Gold’s 14% gain in the quarter. However, the economically sensitive “Black Gold” (oil) fell 18%. Most agriculture commodity prices continued 2024’s rough stretch. Corn, wheat, and egg prices all declined roughly 10% or greater this quarter. While the Federal Reserve no doubt noted these commodity price declines to help justify its September interest rate cut, the grocery shopper and restaurant diner likely have not.

Price fluctuations are just part of the recent volatility story. President Biden unexpectedly ended his campaign for reelection, and former President Trump survived two assassination attempts. Adding to the uncertainty, news sources are increasingly curated for specific audiences and mixed with real and fake news intended to inflame us. Unfortunately, this trend could continue if the lucrative “click-bait” business model persists and our adversaries see us as easy online targets.

“The consequence of an all-out war with a peer or near-peer would be devastating.”

Commission on the National Defense Strategy, July 2024

As for volatility abroad, the challenges in Europe, the Middle East, and Asia have only worsened. The Congressionally authorized Commission on the National Defense Strategy concluded in its July 29th report that the United States faces its “most serious and most challenging” threats since 1945. This conclusion may come as no surprise. What may be a surprise is that the bipartisan commission determined that the U.S. industrial base is currently unable to support our defense equipment and technology needs, let alone those of our allies.

Americans, by nearly six to one, have “hope for the future of the country” versus a “lack of hope.” Tennessean & USA Today/Suffolk University Poll, August 25-28, 2024

Is it simply “the darkest before the dawn,” or are the implications for today’s challenges different from the past? In this commentary, we will discuss asset valuations, recent economic data, and investor positioning. These could affect near-term price volatility and how much the financial lights flicker in coming quarters.

As for the long-term, which is the focus of almost every successful investor, we tend to see the light at the end of the tunnel. And while the path forward may prove volatile, we will err on the side of trusting the ingenuity and aspirations of the American people, whose “hope for the future” has and should continue to fuel future economic expansion.

Today’s Asset Valuations – Already Anticipating a Soft Landing

Thanks to a significant rebound in the past six weeks, U.S. large and mid-capitalization stocks ended the quarter at all-time highs. Non-U.S. and small-capitalization stocks are still 6% and 3% below their 2021 highs. Enthusiasm for Artificial Intelligence (AI) innovations and the infrastructure necessary to support them remain a hot topic. In addition, the prospect of an economic soft-landing has helped broaden the 2024 rally beyond large-cap technology stocks. In fact, nine of the ten sectors of the S&P 500 are up 13% or more this year. Energy is the laggard, up 7%.

The 2024 and 2025 earnings outlook for the S&P 500 declined slightly in recent weeks, primarily due to commodity price weakness weighing on energy earnings estimates. Currently, expectations are for earnings to grow 10% and 15% this year and next. Modest sales growth, coupled with net profit margins expanding 100 basis points (i.e., one full percentage point) above the five-year average, has been a winning formula in recent quarters. (source: J.P. Morgan)

Since stock price gains have outpaced earnings growth, valuation multiples have increased. The market-capitalization-weighted S&P 500 currently trades at 24X and 21X 2024 and 2025 earnings. While historically high, a handful of large-capitalization stocks account for much of this expansion. By comparison, the equal-weighted S&P 500 index trades at 19X and 17X. While still a historic premium, it’s a more palatable one.

As we have often discussed, stocks are forward-looking. And, while the quality and earnings efficiency of today’s U.S. public companies have rarely, if ever, been better, one would be hard-pressed to conclude that today’s valuations have not raised the bar for the anticipated economic soft landing.

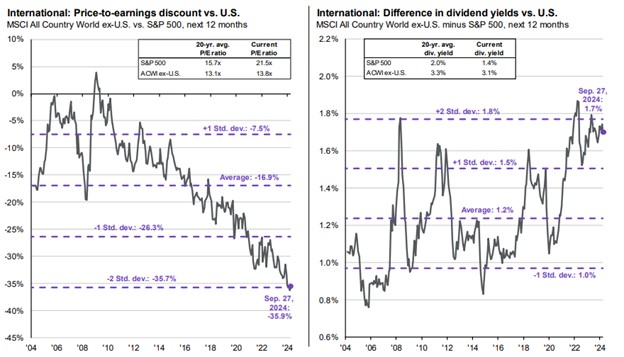

Non-U.S. Stocks Represent a Potential Hedge Against U.S. Dollar Weakness

We have always been and will remain U.S.-centric investors. However, most of our clients have some exposure to non-U.S. stocks, given today’s historically large valuation gap and the investment “free lunch” of diversification.

Source: J.P. Morgan Guide to the Markets

In recent years, uncertainty around global trade policies, the implications of war, and far less technological innovation have mitigated investors’ enthusiasm for global stocks. Never mind the developed markets are historically dependent on slower-growing bank stocks and, to a lesser extent, large pharmaceutical companies. And while a steepening yield curve around the globe could help banks, pharmaceutical companies find themselves increasingly in the political crosshairs, whether focused on cancer or calories.

Nevertheless, growing threats to the U.S. dollar, including coordinated efforts by U.S. adversaries, could reignite interest in non-U.S. assets. In fact, the potential currency hedge is as compelling a reason as any to maintain exposure. In the meantime, the 36% price-to-earnings discount and the 3.1% dividend yield of the global index versus 1.4% for the S&P 500 are certainly noteworthy from a valuation perspective.

It's Tough to Ignore the Data. The Federal Reserve Didn’t.

The current economic cycle has benefited from post-COVID government stimuli and ongoing deficits, re-shoring activities, and cash balances that are three-fold higher today than in 2019. (source: J.P. Morgan) Yet, at its September meeting, the “data-dependent” Federal Reserve reduced the Federal Funds rate by 0.5%, updating its targeting range to 4.75% to 5.0%. This cut proved larger than the 0.25% anticipated just a few weeks ago. Moreover, the market for U.S. Treasuries is currently pricing in a 3.2% Federal Funds rate by mid-year 2025, based on indications from the Federal Reserve that more cuts are coming.

“The size of the cut is a sign of our commitment not to get behind.”

Federal Reserve Chair, Jerome Powell

Clearly, the Federal Reserve has heightened concerns that economic conditions have deteriorated. The persistent “inflation tax” on lower-income households, higher financing costs, and a slowdown in job and wage growth seem to be taking their toll. While we’ll know more with this Friday’s jobs report, a less healthy consumer and a downturn in the index of leading economic indicators provided all the data the Federal Reserve needed.

What About November? For Investors, the Answer May Be in Tax Policy.

While the economic data matter, the additional weight of an uncertain policy picture represents another headwind. According to the Atlanta Federal Reserve and Duke University’s survey of CFO professionals, 45% of respondents have “postponed, scaled down or canceled investment plans because of uncertainty around the election.” This is up from 36% at the end of the second quarter.

Whether this mounting worry proves short-lived may hinge most on the outlook for tax policy. After all, despite Wall Street and private equity’s infatuation with earnings before interest, taxes, depreciation, and amortization (i.e., EBITDA), after-tax cash flow is what justifies growth investments and ultimately funds shareholder distributions. Thus, we suspect many investors, regardless of party affiliation, are focused on how election results could impact corporate tax rates, which the 2017 Tax Cut and Jobs Acts (TCJA) lowered from 35% to 21%. Since the corporate tax rate was one of the few provisions of the TCJA that will not sunset in 2025, most political pundits agree a Republican sweep or some form of gridlock likely means today’s lower rates stay in place.

“I’m proud to pay taxes in the United States; the only thing is, I could be just as proud for half the money.” Arthur Godfrey

Another important TCJA tax break was the 199A provision for certain small businesses. It has allowed over 25 million small businesses annually to take a 20% deduction against their income. This deduction is scheduled to sunset in 2025, along with other tax provisions impacting individual taxpayers. These include today’s historically high estate exemption, the cap on state and local tax deductions (SALT), and the higher standard deduction thresholds.

We discussed the estate exemption in our August insight piece, “One Sunset We’re Watching Closely”, which is available on the Woodmont website. While the estate and other provisions scheduled to sunset are noteworthy (especially if you live in a high-tax state), public equity investors’ focus likely remains on how much, if any, of the TJCA’s lower corporate tax rate remains permanent. As for the potential tariffs and other business-related proposals offered seemingly daily by both candidates, their fate and the market implications will likely unfold over a longer period of time.

No One Likes to Be Left Behind, Especially Investors

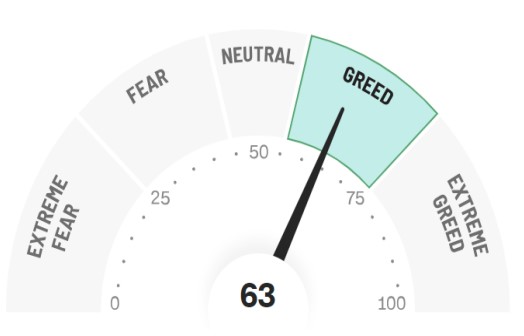

The market volatility index (i.e., the VIX), which is a good measure of investor fear, spiked in early August. While the index has since declined, it remains notably above the historically low levels of late 2023 and early 2024.

Despite the modest uptick in fear, investor fund flows have shown no signs of slowing. Investors have added $325 billion since mid-April and $525 billion since last November to equity funds. (source: Deutsche Bank) If investors are worried about election uncertainty at home, geopolitical risks abroad, and the potential late innings of an economic cycle, the year’s stock market gains and investor fund flows hardly reflect it.

Source: CNN Greed and Fear Index, September 2024

The strong gains and robust investor sentiment can complicate the tone of this market commentary. Put another way, if fund flows had been negative and the Volatility index was at heightened levels, sound counsel would encourage clients to take advantage of lower prices and be “greedy when others are fearful.” After all, history teaches us that the more palpable the fear, the greater the upside and that predicting an economic demise is rarely a winning investment formula.

Investors know executing on this counsel is much easier said than done. That is why we seek to have a plan in place that is reflective of a client’s needs, investment horizon, and capacity for risk. This will not guarantee the outcome, but it does curtail the risks of jumping all in or out at an inopportune time.

Hurricane Helene Proved Devastating

Hurricane Helene’s path proved devastating to residents in Georgia, Florida, North Carolina, South Carolina, and Tennessee. As of today, hundreds are dead or missing, and hundreds of thousands are without power and/or stranded with limited supplies.

Helene was an “unprecedented tragedy that requires an unprecedented response.” North Carolina Governor, Roy Cooper

Fourteen years ago, Nashville endured an unprecedented flood. Yet, the mountainous topography of Western North Carolina and its bordering communities, including the Tennessee tri-cities area, has presented challenges to the rescue and recovery efforts we fortunately didn’t have to confront.

Our thoughts and prayers are with all those affected and the thousands of public servants and volunteers who are working day and night to help with the rescue and recovery. The response, which includes many heroic examples of individuals helping friends and strangers alike, is representative of why we are hopeful for our future.

As always, please let us know if you have questions or if we can be of assistance. Thank you for your continued trust and confidence, and best wishes for a safe and rewarding fall season.

The Woodmont Team

October 1, 2024

This document contains general information only and is not intended to be relied upon as a forecast, research, investment advice, or a recommendation, offer, or solicitation to buy or sell any securities or to adopt any investment strategy. The information does not take into account any reader’s financial circumstances or risk tolerance. An assessment should be made as to whether the information is appropriate for you with regard to your objectives, financial situation, present and future needs.

The opinions expressed are of the date of publication and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Woodmont to be reliable, are not necessarily all inclusive and are not guaranteed as to accuracy. There is no guarantee that any forecasts made will come to fruition. Any investments named within this material may not necessarily be held in any accounts managed by Woodmont. Reliance upon information in this material is at the sole discretion of the reader. Past performance is no guarantee of future results.