In our last white paper, Understanding Social Security - The Basics, we covered how the Social Security System is funded, how benefits are calculated, and key factors to consider when claiming benefits. In this white paper, we dive deeper into spousal and divorced spousal benefits, examining who qualifies and what to consider when claiming based on a spouse’s or former spouse’s earnings history.

Spousal Benefits

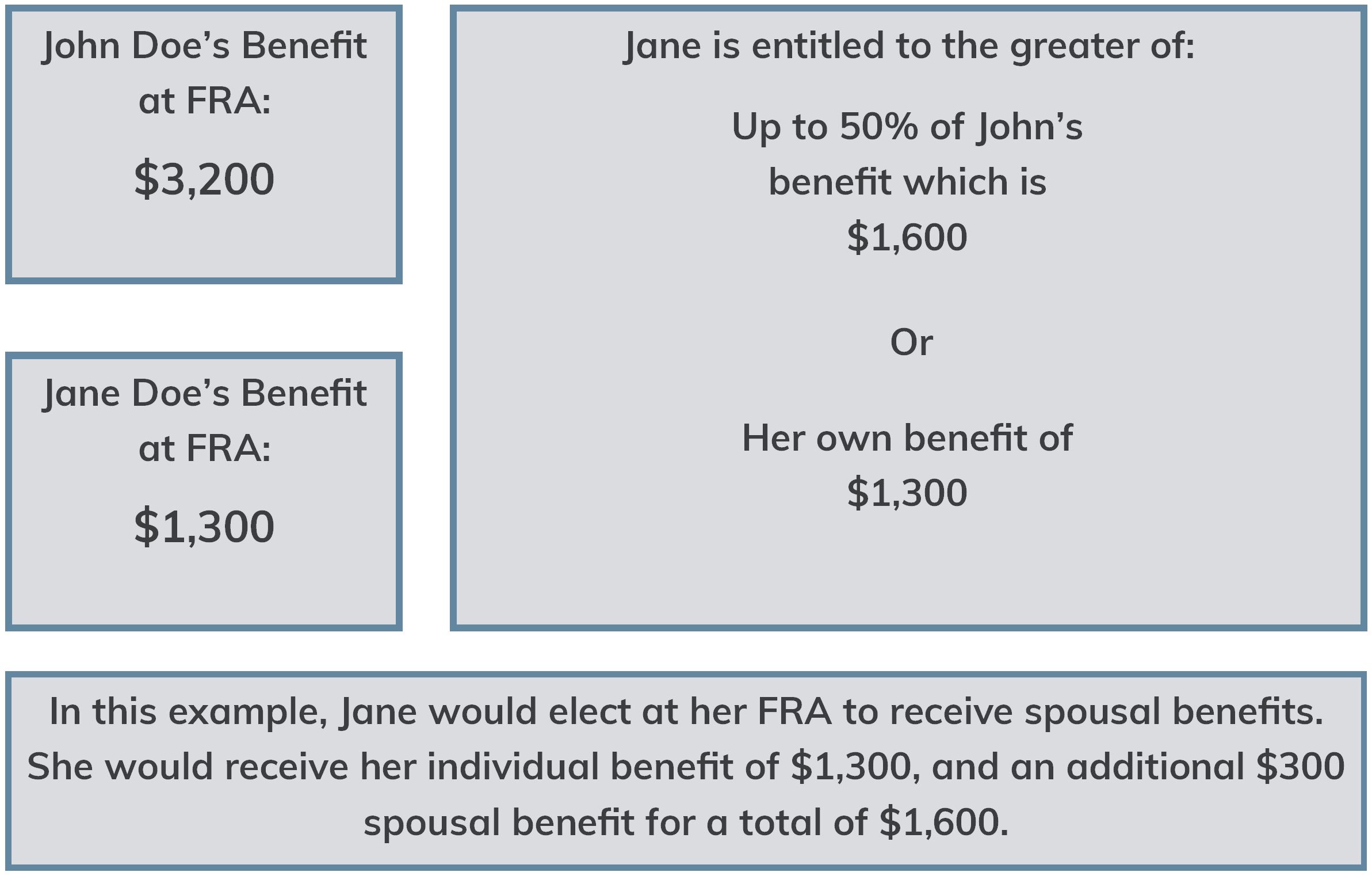

Social Security provides benefits based on an individual’s earnings history. For married couples, a spouse may also be eligible to receive benefits based on the higher-earning spouse’s history. Individuals are entitled to the greater of their benefit or 50% of their spouse's benefit, capped at their full retirement age (FRA) amount, but not both. A married individual who does not qualify to receive Social Security benefits could still be eligible based on their spouse's earnings history.

Eligibility Requirements for Spousal Benefits[1]:

- Must be at least 62 and have been married for one year. While you can claim spousal benefits at 62, it will still be considered early filing (claiming before Full Retirement Age) and will reduce the spousal benefit amount.

- If you care for a child under 16, you can claim spousal benefits with no reduction for claiming early.

- The other spouse must have previously filed and started receiving their benefit.

Filing Strategies for Spousal Benefits

Several strategies are available to married couples when claiming spousal benefits. Deciding when each spouse should begin receiving benefits is key. For some, it may be as simple as each spouse claiming at their respective FRA or delaying to age 70 to maximize their benefits with Delayed Retirement Credits (DRC). For others, the claiming decision will depend on the couple’s unique situation.

For married couples with similar earnings histories that result in comparable Social Security benefits, each spouse will likely choose to claim their own personal benefit. In this situation, couples should consider their retirement cash flow needs, the withdrawal rate of liquid portfolio assets, and the family history of longevity.

For married couples with differing benefits, the spouse with the lower benefit may be eligible for spousal benefits. The illustration below demonstrates how spousal benefits are determined. You are entitled to receive the higher of either your own benefit or the spousal benefit, but not both.

A loophole in the benefits structure previously allowed individuals to claim a spousal benefit at age 62, even if their own retirement benefit was smaller, and then wait until their Full Retirement Age (FRA) to claim their own benefit, letting it grow. This is no longer an option. Now, if you apply for either your own retirement benefit or a spousal benefit, you're "deemed to file" for both. This means you'll automatically receive the higher of the two benefits you're eligible for at that time[2].

Spousal Benefits for Divorced Couples

Divorced individuals may still be entitled to Social Security benefits based on their former spouse's earnings history. Like married couples, individuals are entitled to the greater of their benefit or up to 50% of their former spouse's benefit, limited to their FRA benefit.

To qualify for spousal benefits based on a former spouse, the following requirements must be met:

- Marital Duration and Divorce: You must have been married for at least 10 years and divorced for at least two years.

- Current Marital Status: The lower-earning former spouse (the one claiming benefits) must currently be unmarried.

- Age Requirement: The lower-earning former spouse must be at least 62 years old. Be aware that claiming benefits at age 62 is considered early filing and will result in reduced benefits.

- Higher-Earning Spouse's Eligibility: The higher-earning former spouse does not need to claim their benefits for you to claim spousal benefits currently. However, they must be at least 62 and eligible to receive their Social Security benefits.

It is important to understand that a lower-earning former spouse claiming spousal benefits does not impact the Social Security benefits of:

- Their former spouse.

- Their former spouse's current spouse (if they have remarried).

Filing Strategies for Divorced Couples

If you are eligible for benefits as a former spouse, strategic considerations are similar to those of married couples, including your current cash flow needs, portfolio assets, and life expectancy. You will lose eligibility if you receive spousal benefits based on a former spouse and decide to remarry. However, you may qualify for spousal benefits based on your new spouse if you have been married for at least one year and meet the other eligibility requirements.

Divorcees trying to get the most out of their benefits based on their ex-spouse's earnings history might wonder: Can I claim spousal benefits at my FRA and then delay my own benefit until age 70? Unfortunately, the answer is no. The Deemed Filing rule starts if you claim spousal benefits based on a former spouse's earnings.

Conclusion

Understanding the eligibility requirements is crucial for making informed decisions about claiming your benefits, whether you are currently married or divorced.

If you have any questions about your Social Security benefits, please do not hesitate to contact us. We look forward to hearing from you.

The Woodmont Team

June 24, 2025

This document contains general information only and is not intended to be relied upon as a forecast, research, investment advice, or a recommendation, offer, or solicitation to buy or sell any securities or to adopt any investment strategy. The information does not take into account any reader’s financial circumstances or risk tolerance. An assessment should be made as to whether the information is appropriate for you with regard to your objectives, financial situation, present and future needs.

The opinions expressed are of the date of publication and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Woodmont to be reliable, are not necessarily all inclusive and are not guaranteed as to accuracy. There is no guarantee that any forecasts made will come to fruition. Any investments named within this material may not necessarily be held in any accounts managed by Woodmont. Reliance upon information in this material is at the sole discretion of the reader. Past performance is no guarantee of future results.

[1] Understanding the Benefits, 2025, https://www.ssa.gov/pubs/EN-05-10024.pdf

[2] Filing Rules for Retirement and Spouse Benefits, 2025 https://www.ssa.gov/benefits/retirement/planner/claiming.html