The TCJA also included considerable changes related to estate taxes, such as increases to exempted annual gifting amounts and a doubling of the estate tax exemption. These TCJA changes may or may not have come to light for taxpayers. After all, filing an estate tax return is hopefully a rare and much-delayed occasion.

In the absence of an extension of this legislation, provisions of the TCJA related to the estate exemption are set to expire on December 31, 2025. Given the potential lapse of today’s historically high exemptions, we wanted to explain how this sunset could impact individuals and families planning to pass on significant wealth to their heirs and offer some planning considerations. Importantly, while year-end 2025 is still 16 months away, many of the leading estate attorneys serving our clients have expressed concerns about the feasibility of executing changes to clients’ estate plans just before a potential sunset. Put another way, this is not an issue that can easily be addressed at the eleventh hour.

Estate and Gift Tax Exemptions – The Mechanics

The TCJA dramatically increased the amount an individual could pass on from $5.49 million to $11.18 million without being subject to the current 40% estate tax. Adjusting for inflation, that lifetime exemption is now $13.61 million per individual or $27.22 million per married couple. An individual can also gift for 2024 up to $18,000 per individual without it counting against their lifetime exemption. For example, a married couple could gift $36,000 to a child or $72,000 to the child and their spouse. If the couple has three married children, they could gift $216,000 annually without those gifts counting against their lifetime exemptions.

While many families we work with have for years been making gifts and formed trusts to capture current exemption amounts, asset appreciation and the threat of the sunset mean many more could be impacted. Individuals with a current net worth of $7M+ or a married couple with a net worth of $14M+ may see their assets become subject to estate tax if Congress does not act to extend the current exemption amounts past 2025.

A Case Study

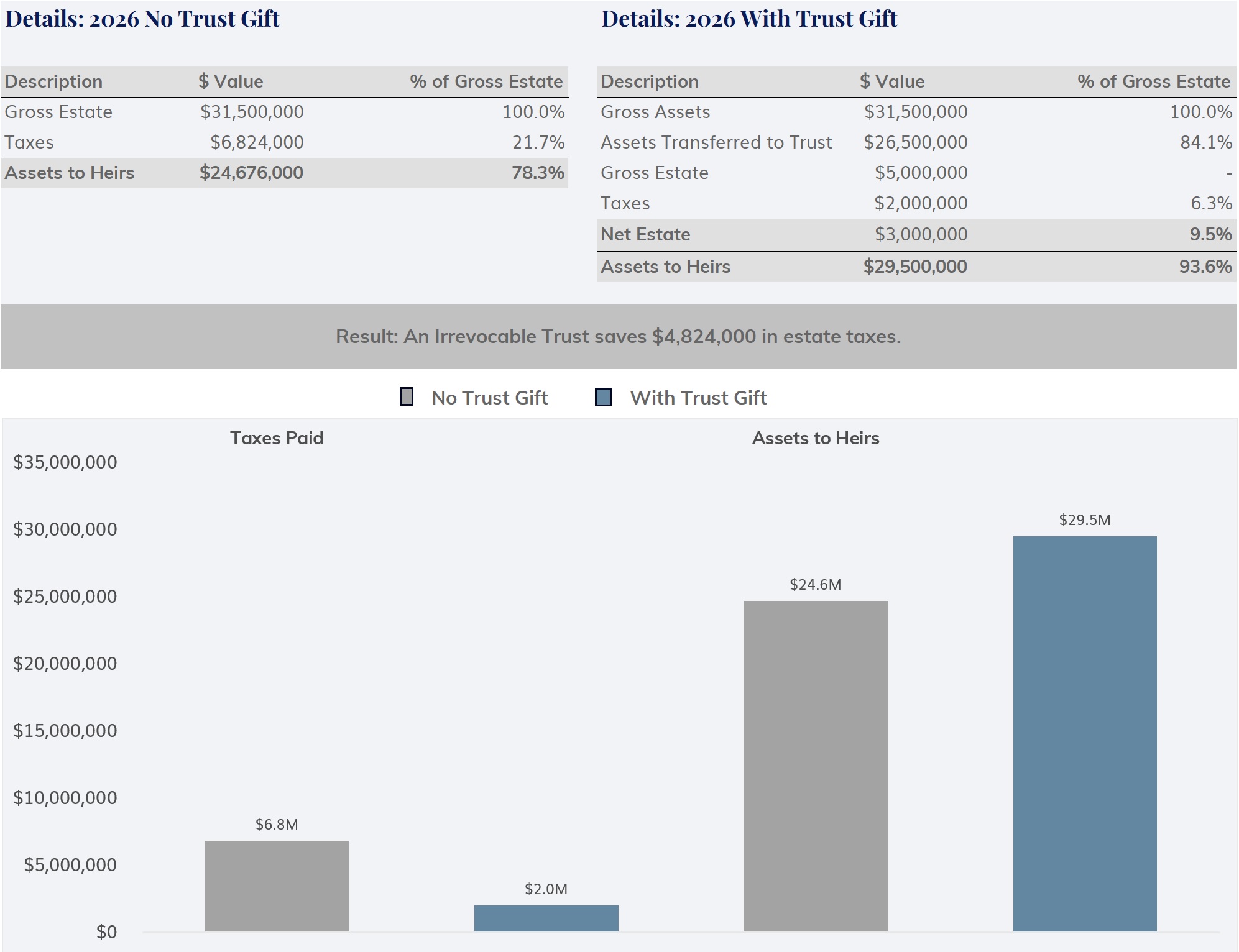

Below is a case study highlighting the potential estate tax savings by proactively planning for a sunset with a $31.5M estate. In this example, preserving current exemption levels results in estate tax savings/additional inheritance of $4.8M. The tax savings result from gifting assets via an irrevocable trust (i.e., “using up” the currently available exclusion amounts) before these higher exemption amounts expire with the anticipated 2025 sunset of TCJA.

This illustration demonstrates how proactive planning can help a married couple reduce potential estate taxes. Actual savings may vary depending on a family’s specific situation, and we advise consulting your legal advisor before executing an estate plan.

Potential Next Steps - Exploring Options

There remains plenty of time to evaluate options and consider the appropriate estate plan for one’s family. We would caution, however, against any advice anchored on the presumption that the advisor knows precisely what will happen with the provisions of the TCJA. The November election and a potentially self-interested Congress cloud the political outlook for this issue. Potential policy scenarios only increase when considering the complications of taxing illiquid assets such as the family farm or business and the resulting implications for basis step-up or charitable giving deductions.

Recognizing the uncertainty surrounding this issue, we offer a few important considerations:

- It is difficult to imagine a scenario where the lifetime exemption amounts are materially increased on the heels of the significant changes from the TCJA. Thus, many families could capture today’s historically high exemptions and still face an estate tax issue.

- We are available to help you and your legal advisors with the analysis, including examining annual gifting scenarios. When factoring in children, spouses, and grandchildren, these strategies can significantly reduce the potential for estate taxes.

- If you wait and the sunset looks imminent, it could be too late as everyone rushes to form trusts and update their legal documents. As an alternative, many estate lawyers recommend taking steps now, and either including triggering provisions or waiting until closer to year-end 2025 to execute those plans.

We acknowledge the inevitability of death and taxes. Yet we also recognize that the tax code presents opportunities for planning so that a family that prioritizes passing wealth to the next generation can reduce the share of their wealth that will go to taxes. We look forward to being a resource as you evaluate your options.

The Woodmont Team