Thanksgiving fell early this year, which meant the resulting holiday shopping season included six weekends. Retailers welcomed the extra time to promote their wares. Shoppers had more time to find an additional gift or two. The combination produced the strongest holiday shopping season in six years – a welcome end to the year for a sector still trying to find its footing in an online world.

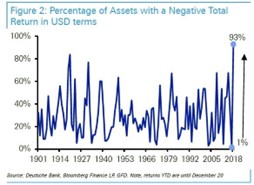

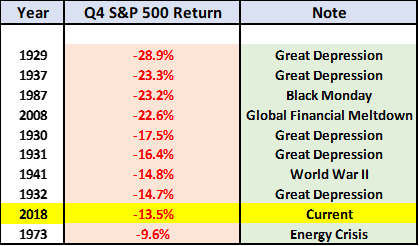

Investors hoping for their own strong end to the year were mightily disappointed. December’s 9% decline was the worst December for the S&P 500 since 1931. As a result of this sell-off, 2018 was the first year since 1948 that the S&P 500 finished negative after being up through the first three quarters of the year.

We know markets tend to surprise investors just when they begin to rely on a particular pattern. The explanation for the December and fourth quarter market malaise, however, is not that simple. On the following pages we’ll recap what turned out to be the most difficult year for all asset classes since 2008. We’ll also provide some insights into how we are approaching 2019.

Some Good News and Bad News

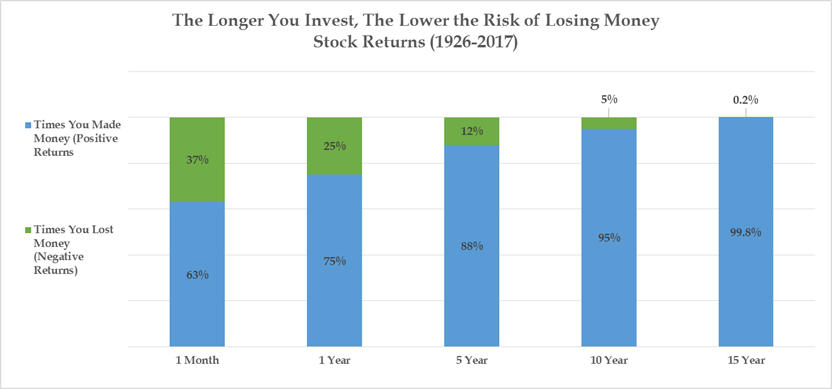

The good news is investing success is a marathon and not a sprint. Also, in most instances we’ve taken advantage of the downturn to add exposure to stocks at cheaper prices and with more attractive dividend yields. The bad news is economies inevitably cycle and no one can predict for certain when the next economic downturn arrives or how long it lasts.

Source: Grant’s Interest Rate Observer

Additionally, investors fear uncertainty. And unfortunately any objective evaluation for well-reasoned policy progress on some of the most pressing issues of our day, reveals a rather uncertain picture. Perhaps as much as anything, December’s investor panic could be linked to increased fear regarding our politics. A government shutdown, resignations, investigations, and 2020 election positioning, are just some of the political unknowns that loom large entering the new year.

Fortunately, a recession is far from inevitable and our economy and financial markets have proven resilient in the face of severe economic, political, and diplomatic challenges time and again. Patience is the investor’s friend. Also, the fact remains that most Americans are focused on pressing ahead versus the headlines.

Source: Blackrock

2018’s Global Stock Correction (Two in One Year!)

U.S. and international stock markets roared higher to start the year only to falter in February and March falling over 10% from their January highs. While overseas markets languished, U.S. stocks recovered. The S&P 500 rebounded 14% from April to September on solid earnings and the strength of Apple, Amazon, and Microsoft, which accounted for almost 40% of the index’s gains at its intra-year peak. Yet by October, the U.S. major market indices had caught what had already sickened the rest of the world and many individual stocks. By year end, U.S. stocks had given up all of their gains and then some. The S&P 500 finished down 4%, including a 20% fall from its September peak to December lows. This compares to the average bear market’s 30% decline. The small-cap Russell 2000 fell 11% in 2018, and value stocks continued to lag growth stocks with the Vanguard Value Index down 5% versus the Vanguard Growth Index down just 3%.

International stocks fared even worse. The MSCI Global Ex-U.S. index was down 14% in 2018. Higher interest rates, a strong U.S. dollar, and trade angst pressured the global indices. The 2018 international stock bludgeoning weighed on diversified equity portfolios. The widely tracked MSCI All-World Index, which is roughly half U.S. stocks and half international, fell 9% in 2018.

Stock Declines Were Just Part of the 2018 Investment Story

Of sixteen widely followed asset classes, only cash and the Barclay’s US Aggregate Bond Index finished the year positive. So much for bonds, gold, or commodities zigging when stocks zag. As bad as 2008 was for global asset prices, five of the 16 major classes posted gains versus just two in 2018. It wasn’t any better for hedge funds, most of which include a downside protection investment mandate. The HFRI Equity Hedge index was down 3% as of November 30. Media reports indicate the index of “hedged” strategies will likely be down more than the S&P 500’s 4% decline for the year. And, as feared, crypto currency enthusiasts got burned. Bitcoin, one of the higher profile offerings, lost 75% of its value in 2018.

What’s Behind the Broader “Correction” for So Many Asset Classes?

The list of what led to the 2018 declines and heightened volatility is rather long. We’ll discuss some of the trading machinations contributing to the market’s wild price swings later in this commentary. As for the fundamentals, they’re a mixed bag. Thanks in part to the tax-reform boost and a rejuvenated consumer, earnings are expected to increase 22% in 2018 once companies report fourth quarter results. It’s the threat, however, of slowing earnings growth in 2019 and a dynamic global landscape that have investors worried. Below we highlight a number of the topics affecting the earnings outlook and influencing the price investors are willing to pay in advance for those expected earnings:

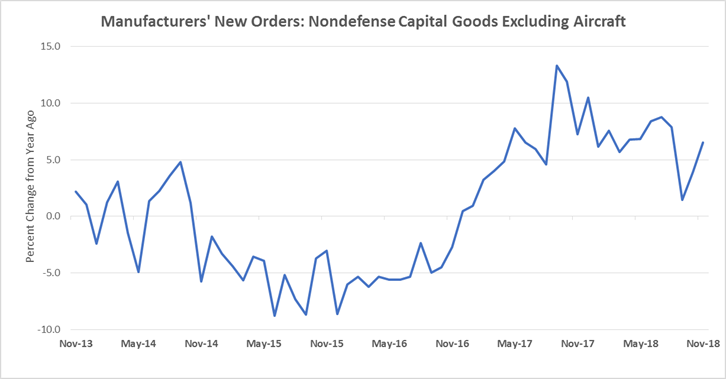

- Trade Tensions: Regardless of the long-term merits of seeking fairer global trade, including much needed protections for U.S. intellectual property, the heated trade negotiations between the U.S. and China have caused many global enterprises to rethink expansion plans and capital investment. FedEx CEO, Fred Smith, said it simply on the company’s December 18 earnings call when he discussed how “our international business, especially in Europe, has weakened significantly since…September” and “China’s economy has weakened in part due to trade disputes.” The U.S. centric portion of our economy remains reasonably strong with recent GDP forecasts still anticipating 2% growth. However, large and small U.S.-based businesses depend upon global commerce for a significant share of sales and/or product inputs. In fact, sales to overseas buyers represent 37% of total revenues for S&P 500 constituents.

Source: Federal Reserve Economic Data

The executive pause that set in mid-year is apparent from the manufacturers’ capital investment chart above. Clearly, the financial markets would welcome a resolution to the ongoing China trade negotiations. Yet expectations for meeting the agreed upon March 1 deal deadline are low. Just last week, China trade hawk and White House advisor Peter Navarro insisted “it will be difficult to reach agreement with China after the 90 day period unless China changes its policies.” This may mean markets are positioned for an upside surprise upon an agreement or substantive progress. Although because President Trump has been quick to hitch his wagon to the stock market barometer, there is likely some expectation of a compromise baked in already.

- Slowing Economic Growth: Economic forecasting is an imperfect science. The old saying is “economists have predicted 9 of the last 5 recessions.” Nevertheless, the latest survey of economists predicts a 10% chance of recession in 2019. The most recent Duke CFO survey suggests nearly 50% odds. A closely watched recession indicator is an inverted yield curve. It is currently flat. While employment remains near record levels and the fiscal stimulus from tax reform is meaningful, a slowing housing market, higher interest rates, and reduced consumer confidence have increased the risks of an economic downturn. Not to mention, we have enjoyed one of the longest economic expansions in history. Whether the markets have sufficiently discounted the much discussed increased risks of recession, or one materializes soon, are impossible to know. We do know markets are forward looking and the fourth quarter declines reflect this increased economic risk to some extent.

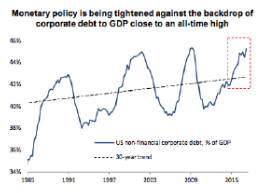

- Higher Rates and Tightening Credit: The Federal Reserve has clearly taken its foot off the economic stimulus accelerator with 2.25% worth of interest rate hikes in 36 months and a reduction of its otherwise unprecedented “Quantitative Easing” bond purchasing program. Its rationale is simple. With today’s economic data still strong, the Federal Reserve believes it is time to quit being so accommodating. Otherwise, it could fuel inflation or have few options to stimulate the economy when the slowdown eventually arrives. Whether the Federal Reserve’s rate hikes and purchasing pause is too late or too early is hotly debated. Some argue the Federal Reserve is too dependent on the economic data and is ignoring other important signals such as the financial markets’ stress, which as of late has included widening spreads between government and corporate credits. Others insist that without rate hikes today while the data is strong, the Federal Reserve loses credibility and an eventual downturn will be exacerbated. Whatever the Fed’s next step, the recent hikes and fears for the continuation of this economic upturn, have resulted in higher interest expense and tighter credit for borrowers. This represents a meaningful headwind for 2019 corporate earnings, especially considering U.S. non-financial corporate debt is near a record 46% of gross domestic product.

Source: DB Research and Federal Reserve

- If Not U.S. Who? For several generations, the United States has been viewed as a stabilizing force around the world. Sometimes going it alone, but more often leading a coalition of our allies, the U.S. has thwarted serious threats of aggression, terrorism, and human rights catastrophes. Secretary Mattis’ recent resignation as Secretary of Defense, highlighted the increased political tension and uncertainty regarding America’s future role in global affairs. Regardless of whether one thinks revisiting our role is unfortunate or long overdue, investors have added this new and complicated variable to their lists of risks. The implications are particularly noteworthy when evaluating our relations with China and Russia. Secretary Mattis called attention to these relationships in his resignation letter noting China and Russia’s desire to “shape a world consistent with their authoritarian model – gaining veto authority over other nations’ economic, diplomatic, and security decisions – to promote their own interests at the expense of their neighbors, America, and our allies.” The communicated U.S. geopolitical vision and the execution of that vision have always been somewhat opaque. Even still, our allies and investors at home and abroad are watching closely given the high stakes for peace and commerce.

Time to Buy Stocks? Better to Add Amidst the Gloom Than the Exuberance.

In our October commentary, we explained how concerns for slower earnings and economic growth warranted holding some cash and short-term fixed-income for most clients. We’re never going to try to time the market or abandon a major asset class. However, our sensitivity for being over exposed to U.S. growth stocks was particularly acute given the multi-year outperformance of the growth-stock heavy S&P 500 relative to value and international stocks.

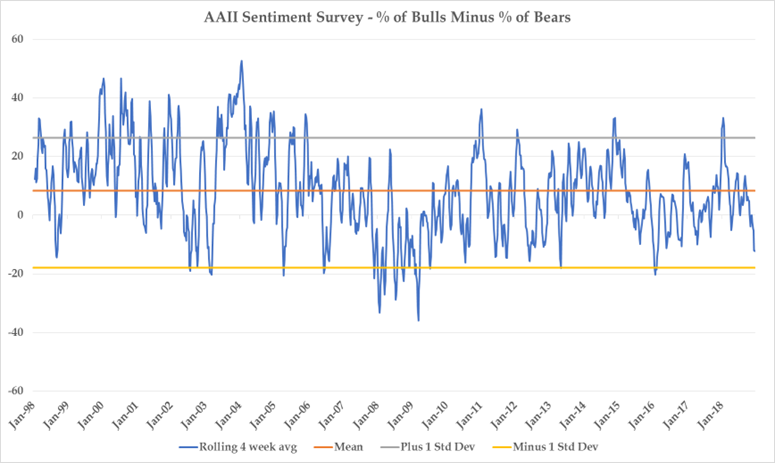

Since October, the consensus Wall Street estimate for 2019 S&P earnings has fallen 2%. This is a relatively modest adjustment, largely driven by a lower energy sector earnings outlook as oil is down 40% since October. As a result of the fourth quarter stock market correction, we’ve modestly added to equity positions for long-term and dividend-centric investors. There is no way to know if we’ve experienced the lows of this most recent correction. Yet with the S&P 500 trading at 14X 2019 earnings, and global stocks even cheaper, our view is the reward for the risks has improved. We’d also much rather buy now that sentiment is fearful and investors are running for the exits en masse versus when they’re exuberant and piling in.

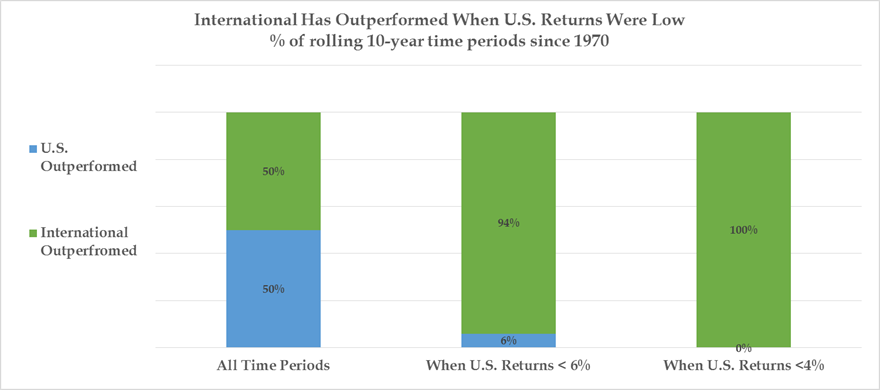

In thinking about 2019, some strategists believe we’ll see more of a “zombie” market for stocks than a “bear” market. That is stocks may not race higher or correct much more, but instead wander up and down in a small range with limited direction. Trying to tacticly trade these smaller peaks and valleys can be tax-inefficient and rarely improves long-term results. There will always be selective opportunities to add exposure to compelling individual securities, and we continue to want investors to have sufficient exposure to cheaper and some faster growing international stocks that have historically performed relatively well when U.S. markets have stalled.

Other than for new accounts, however, we do not anticipate a broad-based increase in client equity exposures absent another severe sell-off or improved earnings visibility. Clients have sufficient exposure to capture the upside from a further market recovery. Moreover, the opportunity costs of this investing patience isn’t what it was a few years ago as higher short-term interest rates provide much better yields for cash and cash equivalents.

Man Versus Machine

The explosive growth of computerized stock trading has dramatically changed the public markets. A recent Wall Street Journal article cited a J.P. Morgan study that concluded approximately 85% of daily market trading volume is now “computer initiated.” Behind the computers are quantitative hedge funds, which are almost one-third of market volume, index investors, and high frequency traders. These strategies don’t rely on a research teams’ thorough assessment of a company’s intrinsic value to make buy and sell decisions. Instead, the computer generated trades attempt to exploit a short-term market trend. This trend is sometimes nothing more than one day’s up or down price momentum.

“Electronic traders are wreaking havoc in the markets” Leon Cooperman, Omega Advisors

The market implications of this growth in passive and computer-generated investing are unclear. December’s declines (down 8% in a four day stretch) followed by the one-day 5% bounce on the 26th is a potential example. As one trader noted, humans don’t make adjustments that fast, just the computers.

Potentially painful in the short run, stocks dramatically re-pricing for non-fundamental reasons presents compelling opportunities for long-term investors. When the machines are indiscriminately and aggressively pushing up or down all of “Mr. Market’s” constituents, we believe it is time to 1) consider adding or reducing investment exposure, recognizing the momentum pendulum has likely swung too far, and 2) identify those individual instances where good companies have been unduly punished or rewarded simply due to a broad computer-driven theme trade. As a result, in future periods you’ll likely see an increased mix of individual opportunities within accounts and in modestly larger concentrations. Simply put, when the computers are trading for the day but our investment horizon is many years, we want to find ways to take advantage of it.

As Life Changes So Will Your Investments

Successful investors must learn to shake off any disappointments, including the “could have” and “should have” thoughts that plague all investors. That is often easier said than done. Yet the goal is for portfolios to reflect the current opportunity set and an investors’ goals for appreciation and income in the context of the risk they are willing to accept. For most investors, these investment variables will change as life’s circumstances change – such as with retirement, a new job or promotion, a business purchase, revised estate plan, and wealth transfers. In 2018, we worked with many clients to consider how these and other life changes may necessitate a different investment positioning. As you look forward to 2019 and consider how things in your life are changing, we want to help. It is an important component of how we serve clients, and part of a necessary dialogue for us to best invest our clients’ assets.

“I do not mistrust the future; I do not fear what is ahead. For our problems are large, but our heart is larger.” President George H.W. Bush (June 12, 1924 – November 30, 2018)

President Bush’s words are noteworthy amidst our uncertain times. Yes, our challenges at home and abroad loom large. Yet when compared to the World War for which President Bush enlisted to help fight on the day of his 18th birthday, it is difficult to argue that we should fear them.

Thank you for your continued confidence throughout 2018. We look forward to answering your investment questions and working together on any new beginnings you expect or are contemplating for 2019.

The Woodmont Team

January 1, 2019