Enacted in 2021, the Corporate Transparency Act (CTA) will require small business owners to report ownership information to the Financial Crimes Enforcement Network (FinCEN). Familiarizing yourself with these changes can mitigate the risks of non-compliance. We encourage you to continue reading to understand if the CTA implications apply to you and your business, as well as the steps you can take to remain compliant.

Corporate Transparency Act – What is it?

CTA is an attempt to broaden data collection for everyday business owners instead of just highly regulated industries or corporations. The business data collection will be through a new report called the “Beneficial Ownership Report,” or BOI.

Who Must File the BOI?

The new law requires compliance from all reporting companies, which were formed with the secretary of state or a comparable office in the U.S. These reporting companies are divided into the following two categories:

Domestic reporting companies - Corporations, LLCs, S-Corps, and any other entities created by the filing of a document with a secretary of state or any similar office.

Foreign reporting companies - Entities (including corporations and limited liability companies) formed under the law of a foreign country that have registered to do business in the United States.[1]

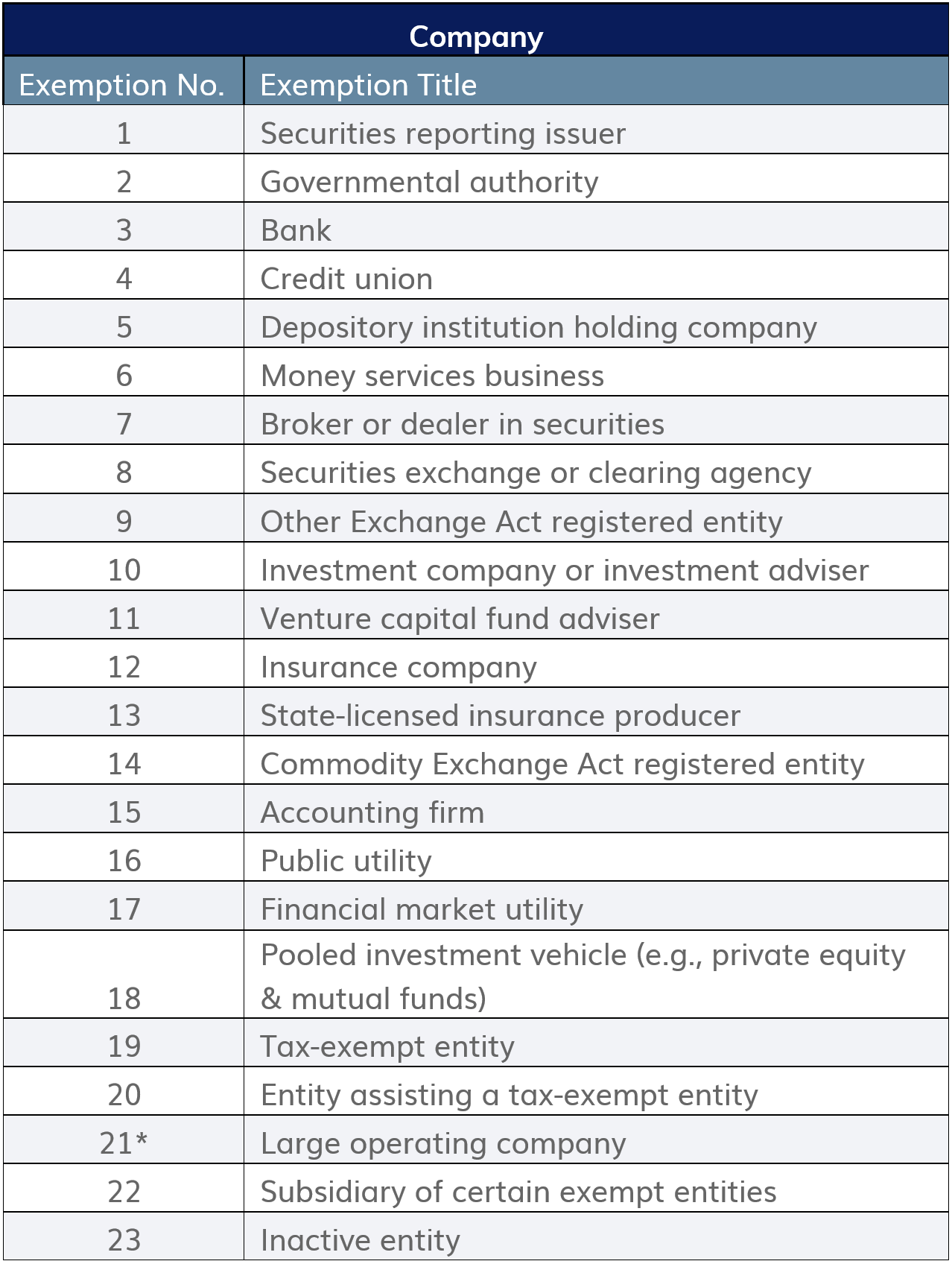

Exceptions to the Law

The CTA exempts twenty-three types of companies. The rationale is to exempt any organization already subject to rigorous federal and state compliance standards. This allows the government to cut down on duplicative information and focus its data collection on LLCs and S-Corps.

*[21] A large operating company is classified as having greater than $5 million in taxable gross receipts, over 20 employees, and a physical office location in the United States

Any sole proprietorships or partnerships that are not incorporated are exempt from CTA.[2]-[3]

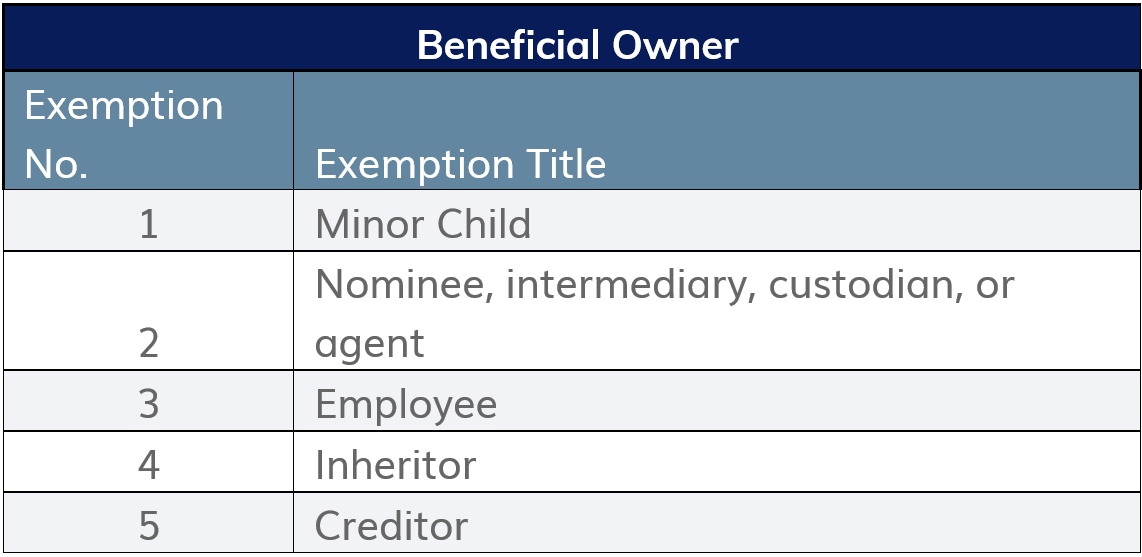

Like businesses, beneficial owners may also receive an exemption from filing. Below is a list of five exemptions:[4]

BOI Reporting Requirements

The BOI reporting requirements are divided into two categories of information: one for the collection of company information and one for the collection of business owner information. Businesses must report the following information:

- Business legal name and trade name

- Jurisdiction

- Current address

- Tax identification number

Once a business fills out information, they will be asked to complete the information for each “beneficial owner.” A “beneficial owner” is classified as holding more than a 25% interest in the company (including trusts) or exerting “substantial control” over the business.[5] They must disclose the following information:

- Name, birthdate, and address of each owner

- ID number and photo from acceptable documentation (Driver’s license or passport)[6]

Reporting Deadlines

The BOI report compliance deadlines are as follows:

- Entities formed before January 1, 2024

- File by January 1, 2025

- Entities formed between January 1, 2024, and January 1, 2025

- File within 90 days of formation

- Entities formed after January 1, 2025

- File within 30 days of formation

Consequences of Non-Compliance

- $500 per day fine, with a maximum $10,000 fine

- Up to a two-year prison sentence

Filing the BOI

Filing is free and can be completed via FinCEN’s e-filing system.[7] All existing businesses and new businesses not exempted must file the BOI. The BOI will only need to be amended when the previously reported information substantially changes.

While many might rely on their CPA to identify and file the BOI, it is not classified as a tax form. Therefore, your CPA may not file the document since it is outside the scope of what they prepare for the IRS.

The CTA Reporting Requirements Are Being Challenged

On March 1, 2024, the Northern District of Alabama (National Small Business United v. Yellen) deemed the CTA unconstitutional. While this ruling only applies to the plaintiffs in the case, it opens the door for increased scrutiny, and additional lawsuits could delay implementation.[8]

Conclusions

Whether the CTA identifies illegal activities as intended or is just another regulatory burden remains to be seen. In the meantime, we recommend business owners and other beneficial owners consider the following:

-

Does the CTA apply to me?

-

When must I comply with the CTA?

-

Who will file the CTA on my behalf?

If you have any questions or we can be of assistance, please let us know. Thank you.

The Woodmont Team

July 16, 2024

This document contains general information only and is not intended to be relied upon as a forecast, research, investment advice, or a recommendation, offer, or solicitation to buy or sell any securities or to adopt any investment strategy. The information does not take into account any reader’s financial circumstances or risk tolerance. An assessment should be made as to whether the information is appropriate for you with regard to your objectives, financial situation, present and future needs.

The opinions expressed are of the date of publication and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Woodmont to be reliable, are not necessarily all inclusive and are not guaranteed as to accuracy. There is no guarantee that any forecasts made will come to fruition. Any investments named within this material may not necessarily be held in any accounts managed by Woodmont. Reliance upon information in this material is at the sole discretion of the reader. Past performance is no guarantee of future results.

[1] Financial Crimes Enforcement Network. (n.d.). Our story. Retrieved from https://www.fincen.gov/sites/default/files/shared/FincenOurStory.pdf

[2] U.S. Small Business Administration. (n.d.). Choose your business structure. Retrieved from https://www.sba.gov/business-guide/launch-your-business/choose-business-structure

[3] American Bar Association. (2024, April). Sifting through the Corporate Transparency Act. Business Law Today. Retrieved from https://www.americanbar.org/groups/business_law/resources/business-law-today/2024-april/sifting-through-corporate-transparency-act

[4] Financial Crimes Enforcement Network. (2023). Beneficial Ownership Information (BOI) small entity compliance guide. Retrieved from https://www.fincen.gov/sites/default/files/shared/BOI_Small_Compliance_Guide.v1.1-FINAL.pdf

[5] Wolters Kluwer. (2024, January). Who is a beneficial owner under the Corporate Transparency Act. Retrieved from https://www.wolterskluwer.com/en/expert-insights/who-is-a-beneficial-owner-under-the-corporate-transparency-act

[6] American Bar Association. (2021, May). The Corporate Transparency Act. Business Law Today. Retrieved from https://www.americanbar.org/groups/business_law/resources/business-law-today/2021-may/the-corporate-transparency-act/

[7] Financial Crimes Enforcement Network. (n.d.). BSA E-Filing System. Retrieved from https://boiefiling.fincen.gov/

[8] Kini, S., Rabie, A., & Steinberg, J. (2024, April 2). Corporate Transparency Act ruled unconstitutional, but scope of judgment is limited. Harvard Law School Forum on Corporate Governance. Retrieved from https://corpgov.law.harvard.edu/2024/04/02/corporate-transparency-act-ruled-unconstitutional-but-scope-of-judgment-is-limited/