We love publishing our July market commentary. The timing reminds us that the summer is still young. It also provides an opportunity to celebrate our nation’s independence, honor the sacrifices that have sustained us, and recognize the foundations our framers put in place to “form a more perfect union.” We’ll discuss some of those foundations in this commentary. This seems fitting at a time when so many clients of all political persuasions cite politics as investment risk factor number one.

"For the support of this declaration, with a firm reliance on the protection of divine Providence, we mutually pledge to each other our Lives, our Fortunes and our sacred Honor."

Declaration of Independence

Declaration of Independence

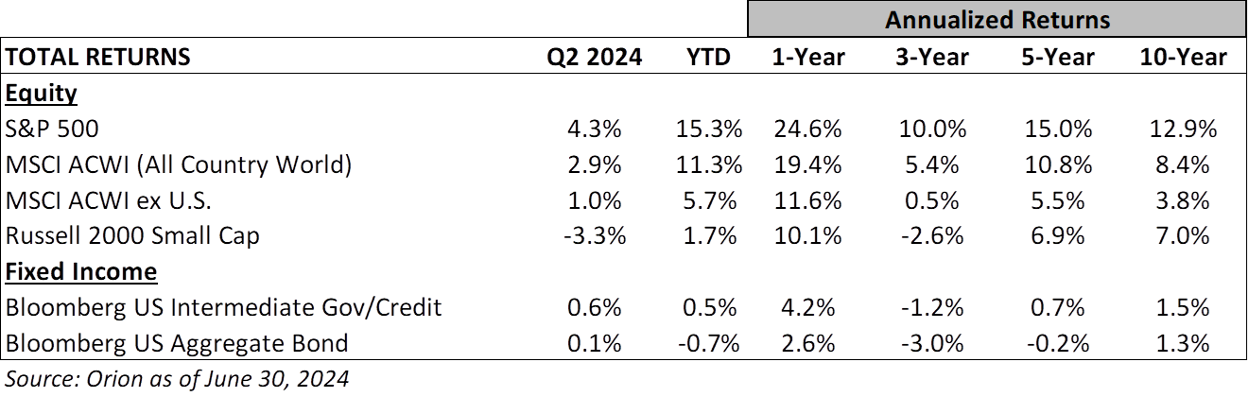

As for the markets, it was a remarkably strong first half of the year for stocks, with the S&P 500 and All-World indices posting returns of 15.3% and 11.3%. The narrowness of the gains (six large-capitalization growth stocks accounted for over 60% of the S&P 500’s year-to-date increase) has many Wall Street strategists quick to cite the risk of this historic concentration. Considering the strategists’ average year-end return forecast for the S&P 500 was 11 percentage points below the gains as of June 30, some context for the angst may be in order. (source: Creative Planning and Charlie Bilello)

We agree that the concentration of returns thus far in 2024 makes for a less-than-perfect market for investors with diversified portfolios (i.e., a portfolio that includes more than just large-cap U.S. growth stocks). At the same time, when change is rapid, and a handful of stock winners could be so dominant, we are grateful a diversified portfolio includes exposure to those best-performing stocks either directly or via broad-market indexes or exchange-traded funds (ETFs). Put another way, there is no “free lunch” in investing. There is a general tradeoff between risk and reward. Even so, the closest thing may be ensuring that investors focused on long-term capital appreciation have a minimum level of portfolio diversification and avoid the temptation to jump in and out of markets.

In this commentary, we will discuss some of the factors impacting stocks and bonds thus far in 2024 and share some insights into our investment positioning heading into the second half of the year. While there is plenty to digest, many themes will be familiar to regular readers. In addition, we hope to remind investors of the risks of fretting too much over a specific near-term event such as the November elections. This is never easy, particularly when most agree the choices are far from perfect.

What A Difference a Trillion, or Two, or Three Makes!

2022 was a historically bad year for investors. Five Federal Reserve interest rate hikes and the anticipation of more to come took their toll on bonds and stocks. Economists widely assumed the increase in borrowing costs and diminished wealth effect from lower asset prices would push us into recession sometime in 2023.

Fast forward to the middle of 2024. A recession has yet to materialize thanks to the trillions of savings and liquidity held over from COVID-related stimuli, a vigorous consumer, and an acceleration of reshoring activities. Not to mention, the wealth effect has been in full force due to the trillions in stock market gains anticipating an Artificial Intelligence (AI) “industrial revolution.” In fact, at this time in 2022, there were four companies with market capitalizations greater than one trillion dollars with two of those eclipsing $2 trillion. Thanks largely to AI-related investor optimism, today, there are six with a combined market capitalization of $15 trillion or 32% of the S&P 500. For context, the value of the entire S&P 500 in March of 2009 was $6.1 trillion, or about 2X the market capitalization of Nvidia (NVDA).

Our July 2023 market commentary was titled Hot Dogs, Apple Pie, and AI. We understood AI represented a significant development and accordingly made some adjustments to portfolios where appropriate. Yet few (us included) anticipated the magnitude of the market transformation that ensued and how quickly the subject of AI has come to dominate investor attention.

So, Now What?

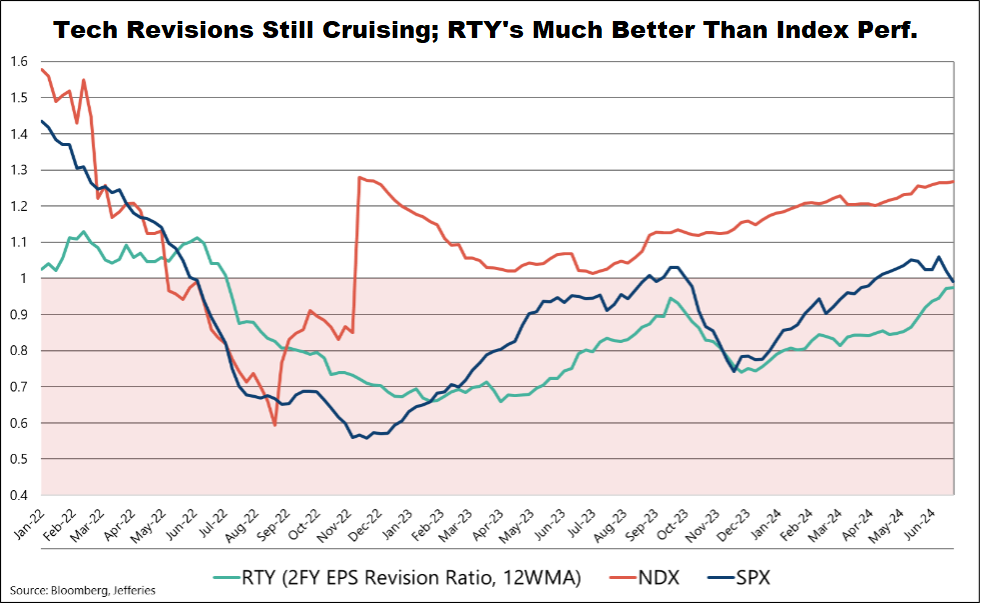

The S&P 500 currently trades at 22.5X 2024 and 19.6X 2025 estimated earnings. In recent months, Wall Street analysts’ forecasts have increased modestly for this year and next despite the historic pattern of out-year estimates proving too optimistic and declining over time. (Source: FactSet). This isn’t to say there aren’t chinks in the armor. Many high-profile retail and consumer-facing companies have recently reported disappointing results and warned of a challenging outlook. This is apparent from analysts’ estimate reductions exceeding estimate increases in recent weeks other than in the technology sector. (source: Jefferies & Co.)

Moreover, consumer confidence data seems to have peaked. How much of the recent consumer sentiment downturn and earnings disappointments are a broadening economic slowdown or reordering of spending priorities (e.g., more travel and entertainment) is not yet clear.

Nonetheless, it is important to consider whether current stock prices have discounted the increased uncertainty. With price-to-earnings (P/E) ratios notably above the 16X twenty-five-year average, some would argue the “margin of safety” has eroded. Others would point to a mere continuation of the technology-“haves” versus all other economic sectors’ “have-nots.”

Either way, it is worth noting the P/E drops to 16X for the equal-weighted S&P 500 index and 17X if we exclude the index’s ten largest constituents. Put simply, while earnings for the average stock have held reasonably firm, the prices have lagged considerably, up just 23% since this time in 2022 compared to 48% for the market-cap-weighted S&P 500 and 70% for the Vanguard large-cap growth index.

We will not bet against a continuation of the benefits of this potential AI-initiated “industrial revolution.” Thus, we generally plan to hold firm to the large growth stocks and sector ETFs that have benefited. However, it is nice to know that most stocks do not cost a trillion dollars or two or three.

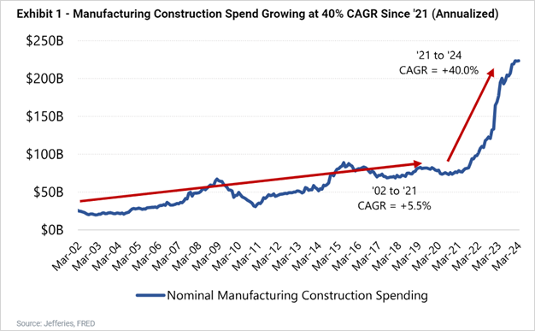

Some Reshoring Context

For several years, we’ve cited the reshoring and nearshoring trend in our market commentaries as a potential multi-year tailwind. The COVID crisis was a catalyst, but more recently, a push to make computer chips at home and unprecedented data center expansion activities have emerged as big drivers of this trend. The chart below, which would include about $50 billion of annual CHIPS and Science Act government spending over the next five years, provides context for the magnitude of this shift. Specifically, investments in manufacturing construction will approach $250 billion in 2024. This is nearly four times the average annual investment from 2010 to 2020.

It is easy to extrapolate the benefits of this trend to construction-related industries, utilities (one large data center consumes the power equivalent of 500K homes), and skilled labor. What is more challenging is determining how much this shift has contributed to inflation and if that pressure could prove persistent for years to come.

“Things that Have Never Happened Before Happen All the Time.” Scott Sagen as quoted in the Psychology of Money by Morgan Housel

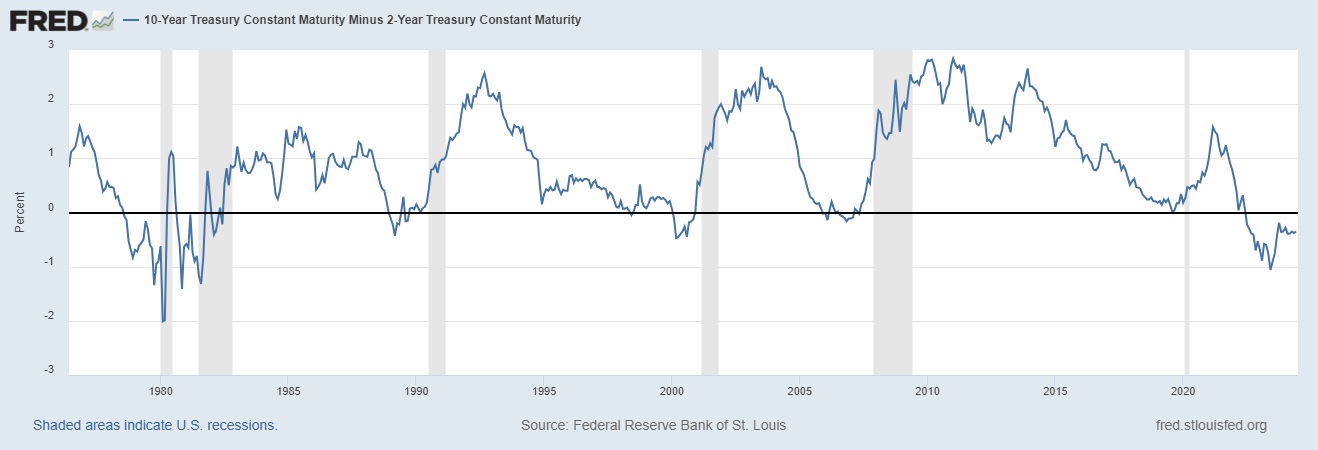

For decades, investors and economists have watched the spread between the yield on a two-year U.S. Treasury and its ten-year counterpart. The yield has inverted (i.e., the two-year Treasury now yields more than the ten-year) anywhere from six months to two years in advance of every recession since 1955. (source: Reuters, 2023, San Francisco Federal Reserve). Per the chart below, this spread inverted in July of 2022 and has widened recently, though it is still well below the 1% spread reached last year.

No one knows how much longer this economic expansion cycle will last. Some argue we’ve entered a period where the expansions are longer but the downturns more severe. This resonates at some level, particularly given the large government budget deficits we’ve run in recent years, which presumably trade short-term gains for long-term pains.

For investors, trying to time an economic downturn is ripe with challenges. Attempting to anticipate the magnitude and sector implications only adds to the risks. A much better approach is to let one’s needs, investment horizon, and capacity for risk determine how much investment risk to accept and when. This approach is why our conversations with clients, which include a comprehensive review of their financial situation and objectives, are so important.

Bond Yields Are Down from Recent Highs

U.S. Treasury bond yields are well below last fall’s peak. For instance, the Ten-Year Treasury stands at 4.4% versus just under 5% in October 2023. At the beginning of the year, markets anticipated six to seven Federal Reserve rate cuts of 0.25% each. On the heels of Friday’s inflation data, the probability of a single cut in September stood at 67%. (source: FactSet). It’s been a volatile bond market by any measure, with investors reacting to every inflation data point and Fed Governor interview.

While it is impossible to ignore Federal Reserve headlines and inflation data, we try to focus less on predicting the Federal Reserve’s near-term actions and more on evaluating whether committing capital at current yields represents an attractive option, given all we know about the investment landscape and a client’s objectives. This approach helped us avoid the pain of major bond price declines in 2022. More recently, it has warranted extending duration, which recently included swapping 2024 and 2025 maturing bonds for 2029 bond exposure.

Even still, we remain sensitive to generally avoiding long-bond exposure. Labor challenges, possible tariffs, government deficits, and debt are all potential inflationary forces. And while we’ve increased bond portfolio duration these past eighteen months, we prefer to take our risks in stocks and other equity assets and limit the bond price downside if inflation proves more structural than cyclical. Today’s 5.25% Federal Funds rate is hardly a historic aberration. Moreover, if an equity market correction warrants increasing client exposure to stocks, we do not want underwater long bonds to limit our flexibility.

November Is Upon Us. Should We Be Concerned?

Conventional wisdom says the uncertainty around a contentious Presidential race with major tax and regulatory policy implications makes it tough for equity markets to fare well. Yet, the first half of 2024 represented the best start for the S&P 500 in a Presidential election year and one of the better first-half performances in years.

For those who are worried, not necessarily about November but our increasingly restless political climate and the lack of substantive solutions to our greatest policy challenges, we found helpful the recent work of Yuvai Levin, a historian with the American Enterprise Institute. As outlined in a Wall Street Journal review of his new book, American Covenant, Levin poses that the U.S. Constitution is a foundation that won’t just keep us from fracturing but can also bring us together. With its laudable objective to “form a more perfect union” and protect our freedoms and the minority voice (think how hard it is to pass a law in the Senate), few can dispute the U.S. Constitution’s foresight for governing a culturally diverse nation of independent thinkers. And while brilliant, its roots were steeped in pragmatism. As divided as we are today, our nation was even more “fractious and disunited” when the Framers drafted the Constitution. (source: Wall Street Journal).

As for the path forward, Mr. Levin argues we must hold dear to the protections of a liberal democracy but also remember the duties of a republic. According to Mr. Levin, we can’t focus simply on protecting freedoms (albeit a vital objective), but we also must think about the future society we want subsequent generations to inherit. Through that lens, one begins to consider not just the protections they are owed but also what they may owe others in the form of the “duties and responsibilities” crucial to sustaining a republic. (source: Wall Street Journal). The quote below from President Lincoln captures this well.

“A statesman is he who thinks in the future generations, and a politician is he who thinks in the upcoming elections.” President Abraham Lincoln

We’re not so naïve to think today’s tensions and often media-fueled divisions won’t complicate the emergence of leaders who think first about the Republic. We are confident, however, that our biggest policy challenges will eventually get addressed, if not ahead of time, at least in the nick of time. That’s our pattern these past 248 years, and we are far from ready to conclude we are no longer up for the task.

As always, please let us know if you have questions or if we can be of assistance. Thank you for your continued trust and confidence, and best wishes for a safe and rewarding summer season.

The Woodmont Team

July 2, 2024

This document contains general information only and is not intended to be relied upon as a forecast, research, investment advice, or a recommendation, offer, or solicitation to buy or sell any securities or to adopt any investment strategy. The information does not take into account any reader’s financial circumstances or risk tolerance. An assessment should be made as to whether the information is appropriate for you with regard to your objectives, financial situation, present and future needs.

The opinions expressed are of the date of publication and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Woodmont to be reliable, are not necessarily all inclusive and are not guaranteed as to accuracy. There is no guarantee that any forecasts made will come to fruition. Any investments named within this material may not necessarily be held in any accounts managed by Woodmont. Reliance upon information in this material is at the sole discretion of the reader. Past performance is no guarantee of future results.